A new report out of analyst firm Intersect360 Research is shedding some new light on just how valuable the HPC and AI market is. Taking both of these technologies as a singular unit, Intersect360 Research found that the HPC-AI market size reached $85.7 billion in 2023.

The report states that this market size is up 62.4% year-over-year. The cause for this increase seems to be spending by hyperscale companies on their AI infrastructure, which nearly tripled compared to 2022 rates.

The hyperscale market is comprised of organizations with a business focus on accessing, processing, and disseminating information through the Internet. Hyperscale companies often provide services like web search and categorization, online retail and customer identification, content hosting and distribution, social media, communications, pattern recognition, massively multiplayer online games (MMOGs), and more.

Although Intersect360 Research has been tracking the hyperscale market for many years, the organization has recently decided that AI has combined HPC and hyperscale into a single market. According to the paper, AI with HPC infrastructure is being pursued by hyperscale businesses, traditional HPC customers, and non-HPC enterprise computing users for both training and inference. There is a need for a combined understanding of the HPC-AI infrastructure industry due to the overlapping of these formerly distinct buying segments needs.

With this combined view of the market, Intersect360 Research focuses on two primary segments: Hyperscale companies and on-premises HPC-AI infrastructure.

Hyperscale AI infrastructure spending increased to $48.4 billion, which was a massive 170.2% increase over the previous year.

“This dramatic growth in hyperscale AI is akin to a gold rush,” said Intersect360 Research CEO Addison Snell. “It belies any normal market dynamic. It is the confluence of multiple constituencies simultaneously charging into the AI race.”

The report goes on to mention that prices are currently elevated here due to many important components being in short supply. Specifically, the GPUs necessary to provide the majority of computation for training and inference are becoming harder to acquire.

In contrast, the on-premises HPC-AI infrastructure market grew to $37.3 billion in 2023, up 7.1% compared to 2022. The report mentions that 2023 was the first year in which hyperscale companies’ spending on AI infrastructure exceeded the entirety of spending for on-premises infrastructure for HPC-AI.

The report also made a point to mention that each of these segments only represents a portion of a larger whole and that there is both on-premises computing and hyperscale infrastructure not dedicated to AI.

Intersect360 Research found that on-premises HPC-AI grew to 30.9% of all on-premises spending, which was a marginal increase over the 28.6% represented in 2022. On the other hand, the AI portion of hyperscale infrastructure grew to 28.8%, which was more than double the 14.2% proportion in 2022.

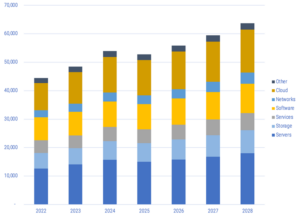

Looking to the future, Intersect360 Research predicts a flattening of the market’s growth. The market for on-premises HPC-AI infrastructure will grow at a 5.4% CAGR, eventually reaching $48.6 billion by 2028. However, this will be offset by a decrease in hyperscale AI spending, which will see a -4.6% CAGR in the coming years. By 2028, hyperscale spending will reach $38.2 billion. Overall, this will result in a .3% CAGR for the combined HPC-AI infrastructure spending.

Despite the flatting of the total outlook between now and 2028, the report predicted a volatile ride to that end. On-premises HPC-AI will see double-digit growth in 2024 as the current demand for AI systems remains high. However, this will be followed by a dip in 2025 as increases in GPU supply catch up. The report predicted that steady growth will resume in 2026.

Alternatively, hyperscale AI demand will see the kind of volatility that should be expected from a market segment that is comprised of relatively few companies. Intersect360 Research predicted a slackening in demand for AI infrastructure in the coming years, with steady growth returning in the beginning of 2026.

Of course, this is only a taste of what Intersect360 Research wrote on this topic, and those with a deep interest in where the HPC-AI market is heading should make sure to download the full report. What’s more, Intersect360 Research will also be presenting the information from this report at a free webinar on Thursday, May 2 at 12:00pm Eastern/9:00am Pacific. Snell will be joined by Intersect360 Research’s Chief Research Officer Dan Olds as well as Senior Analyst Steve Conway to discuss the information contained within the report.

#AI/ML/DL #Slider:FrontPage #AI #HPC #HPC-AIMarket #Intersect360 #Intersect360Research [Source: EnterpriseAI]